Financial Aid

Frequently Asked Questions

Applying for Financial Aid

Communication with the Financial Aid Office

Receiving Financial Aid Funds

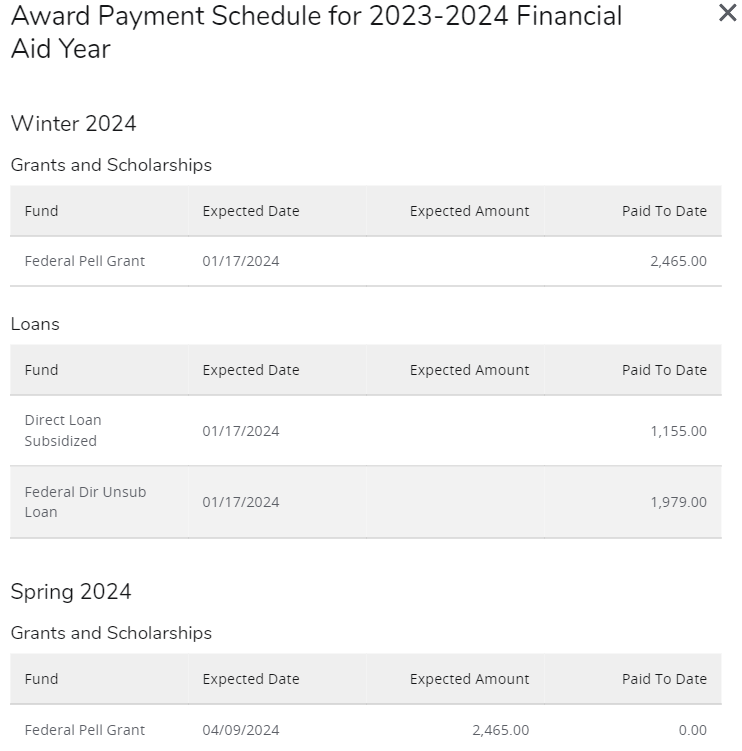

You can check your aid by logging into WebRunner. Click on Financial Aid, then Financial Aid Dashboard, which brings you to the homepage. Click on Award Offer, then click on View your Award Payment Schedule.

A new window will open and detail your aid by term, the expected disbursement date, the expected disbursement amount, and the amount paid to date. The example below details funds that have already been disbursed for the Winter 2024 term and expected funds for Spring 2024.

Direct Deposit is a convenient option offered by the LBCC Business Office to have your financial aid refunds deposited quickly and safely into your bank account.

Sign up for Direct Deposit by logging into WebRunner:

Click on "Personal Information" menu

Then go to "Direct Deposit Authorization for Student Financial Aid / Tuition Refunds"

Remember to update your WebRunner banking info when there are changes

Yes, many students can. Students who have already been awarded financial aid and have enough aid to cover their tuition and fees owed may have an available charge for their books and supplies at the LBCC Bookstore. This amount will be listed on each student’s WebRunner account.

- Charges can only take place beginning the Monday prior to the term through the end of the first week

- When your financial aid applies to your account, tuition, fees, and bookstore charges will be deducted from the refund amount that is sent to you

Example: Robby has been awarded the Pell grant for $1200 at full time status. He also has loans for another $1000 and he has already accepted and completed the Entrance Counseling and Master Promissory Note. He is enrolled in 12 credits (full time) and owes $1092 for tuition and fees. Beginning the Monday before the term, Robby will have the following bookstore charge:

$2200 for total financial aid - $1092 owed = $1108 total bookstore charge.

If Robby charged nothing at the bookstore, he would receive $1108 in a refund on the date of disbursement. Anything he charges simply comes out of the refund he is later due. If he charges $500 for books, for instance, he will receive $608 when financial aid is disbursed.

Note: Your bookstore charge is dependent upon your enrollment level. Waitlisted classes will not count toward your enrollment level.

What are federal Title IV funds?

Title IV funds are federal student aid funds, from federal student aid programs administered by the U.S. Department of Education. The U.S. Department of Education regulations only allow schools to use Federal Student Aid to pay for current academic year institutional charges unless the student has granted permission to apply these funds to non-allowable charges as well.

Title IV funds include:

- Direct Subsidized/Unsubsidized Loans

- Direct PLUS Loans

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (SEOG)

Federal Title IV funds do not include scholarships from the College, the state, or other private organizations.

Allowable charges:

- Tuition

- Mandatory fees (student fees, technology fees)

Non-Allowable charges include:

- Bookstore charges

- Parking fines

- Library fines

- Late payment fees

How are Title IV funds applied to my account?

The U.S. Department of Education requires that Title IV funds be applied to specific allowable charges. Allowable charges include tuition and mandatory fees. If your total of Title IV funds exceeds the total of these qualifying charges, the College must refund that excess to you unless you give permission to do otherwise.

Late payment fees that are assessed to your account are not considered allowable charges, even if you consent to apply your Title IV funding to this specific charge.

Does the authorization need to be acknowledged each year?

Yes. The authorization remains in effect for the current academic year. The student may rescind or change their response by sending a written request to the Office of Financial Aid. The Office of Financial Aid will reset access to the authorization questions and the student can provide an updated response. If the student rescinds or changes their response after their Title IV fund disbursement, the new response will only apply to future funding.

What does the authorization say?

I authorize Linn-Benton Community College to apply any Title IV excess funds toward prior award year non-allowable charges, as allowed by federal regulations. Currently, regulations allow up to $200 to be applied towards prior award year non-allowable charges.

By agreeing to the terms and conditions, I authorize Linn-Benton Community College to apply Title IV funds to any non-allowable charges on my student account for the academic year for which the funds are received. I authorize Linn-Benton Community College to return any excess of Title IV via direct deposit or check and not hold my funding to apply to future charges that I may incur.

I understand this is a voluntary authorization and is valid from the date of signing through the end of the current academic year. At any time I can cancel this authorization with the Office of Financial Aid. I further understand that I will be responsible for paying any outstanding debts if I cancel this authorization. For any outstanding balance, a financial hold will be placed on a student’s account that will prevent future course registration or transcript releases until the account is paid in full.

- If a student agrees to all authorizations above, federal funds can be used to pay for other charges such as library fines, parking fines, and bookstore charges, and can be used to pay for a prior year's account balance up to $200. If the student has any excess of Title IV funding, these funds will be issued via direct deposit or refund check to the student.

- If a student does not agree to all authorizations above, a billing statement will be issued requesting payment for any charges on the student's account that were not covered by Title IV funding.

What if I don't grant the authorizations?

If you do not grant authorization, your federal financial aid and loans cannot be used to pay for charges other than tuition, and fees. Any excess aid will be refunded to you. Therefore, you may receive a refund and may simultaneously be notified of your bill for any charges that could not be paid with your Title IV aid. Receiving a refund does not indicate that there are no pending charges on your account.

Example student account with and without authorization

Financial Aid Award Offer(full-time, per term)

Federal Pell Grant - $2,165

Stafford Subsidized Loan - $1,167

Stafford Unsubsidized Loan - $667

Total Aid per term - $3,999

Student Account Billing (12 credits per term)

Tuition - $1,521.96

Fees - $96.00

Student Government Fee - $11.50

Library fine - $10.00

Bookstore Charge - $900.00

Total Charges - $2,539.46

A student who agrees to authorize Title IV funds to pay for other charges such as library fines, parking fines, and bookstore charges.

$2,539.46 (all charges on account) - $3,999 (financial aid accepted) = $1,460 (refund

to student)

Account Balance = $0

A student who does not agree to authorize Title IV funds to pay for other charges such as library fines, parking fines, and bookstore charges.

$1,629.46 Allowable charges ($1,521.96+96+11.50) - $3,999 (financial aid accepted)

=$2,369.54 (refund to student)

$2,539.46 (all charges on account) - $1,629.46 (paid charges)

= $910 Account Balance

Financial Aid Eligibility and Academic Standards

You must meet the Satisfactory Academic Progress (SAP) requirements in order to remain eligible for financial aid. Failure to meet these standards will result in being placed in an Unsatisfactory Status and the loss of financial aid eligibility (Federal Grants, State Grants, Direct Loans, Federal Work Study, and Scholarships) for all future terms, unless you successfully petition for reinstatement.

If you have extenuating circumstances, you should complete a Financial Aid Appeal Form.

If your Unsatisfactory Status was not based on extenuating circumstances, you must enroll and successfully complete six or more credits without the assistance of financial aid. Once this task is complete, you will be able to request reinstatement of your financial aid by completing the Financial Aid Appeal Form. Reinstatement is not guaranteed.

Academic Standards for Financial Aid

Federal Regulation requires students who receive financial aid to maintain Satisfactory Academic Progress (SAP) towards completing a financial aid eligible degree or certificate at LBCC. In other words, you are expected to pass the classes you register for at LBCC each quarter. SAP passing grades are: A, B, C, D, and P (Pass).

Grades that are NOT considered passing are: F, NP (No Pass), IN (incomplete), W (withdraw), and AU (audit).

Students who apply for financial aid at LBCC receive an initial SAP review prior to being awarded. Also, SAP reviews are completed at the end of each quarter that aid is received. If you are a student who has been attending without financial aid assistance but decides to apply for aid, your prior coursework will be part of the SAP review.

In simple words, all courses that you take at LBCC will be part of your SAP review regardless of whether or not financial aid assistance was received.

Once you are awarded financial aid at LBCC, you are expected to utilize your Academic Advisors, Counselors, Center for Accessibility Resources, along with other services offered to assist students with success towards completion of their certificates or degrees.

In accordance with our SAP policy you will:

- Maintain a Cumulative Grade Point Average (GPA) of 2.00 (C Average) *Needs to be maintained every term at LBCC

- Maintain an overall completion ratio of 70% during your academic career at LBCC *Needs to be maintained every term at LBCC

- Attempt to successfully complete all the credits for which you receive aid each quarter

- Register and complete only the credits required for your program of study at LBCC

Students are expected to complete 100% of the credits for which they receive aid. Credits completed will be reviewed at the end of each quarter to determine your SAP status. Refer to the chart below and the Student Expectations above to understand your SAP Status.

| If you Enroll: | You must successfully complete: SATISFACTORY | You Will be Placed On WARNING if you only complete: | You will be placed on UNSATISFACTORY if you complete less than: |

| Full Time(12 or more credits) | 12 credits per quarter | 6-11 credits per quarter | 6 credits per quarter |

| Three Quarter Time (9-11 credits) | 9 credits per quarter | 5-8 credits per quarter | 5 credits per quarter |

| Half Time (6-8 credits) | 6 credits per quarter | 3-5 credits per quarter | 3 credits per quarter |

| Less Than Half Time (1-5 credits) | All credits per quarter | Not Applicable | All credits per quarter |

Financial Aid Warning: A student placed on warning must ‘successfully’ pass all the courses in the next term of enrollment at LBCC. Failure to meet these conditions will result in Unsatisfactory Progress. Students cannot appeal a warning status:

Example: Mary is registered at FT status (12 credits) for Fall quarter. At the end of the quarter the financial aid office runs a SAP policy and learns that Mary completed 10 credits. Using the chart above, Mary is on warning for her next quarter of aid (Winter). Mary will need to have a 100% completion ratio for Winter quarter or she will be in unsatisfactory progress when another SAP is run at the end of Winter quarter.

Financial Aid Unsatisfactory Progress: Students who do not complete any of their classes* in a given quarter may owe money back. Be aware that overpayment must be paid in full before a Financial Aid Appeal Form may be considered.

*If you withdraw or stop attending all courses before 60% of the quarter is over, you may be required to repay a portion of the aid that you received. Please check in with the Financial Aid Office if you plan to withdraw or drop any courses after you have been paid for the quarter.

For more information, see Satisfactory Academic Progress Policy (PDF).

Altering Your Schedule

Financial Aid will be paid on the number of credits you are enrolled in as of the tuition due date for each term. If you drop a class before the tuition due date, you will not be paid financial aid for the course and your Academic Standing for financial aid will not be affected. Dropping or withdrawing from classes after the tuition deadline, however, may affect you. Students are expected to stay in compliance with the Satisfactory Academic Progress (SAP) requirements.

On the Academic Standards page is a chart that shows what will happen to a student’s financial aid if he or she fails to complete all of the attempted credits. In addition to the chart, students are expected to maintain a 2.00 GPA. Additionally, students who do not complete any classes may owe a repayment of their financial aid and may be denied financial aid at LBCC and all schools until the repayment has been made.

Oregon Opportunity Grant

The Oregon Opportunity Grant is a state grant administered by the Oregon Office of Student Access and Completion (OSAC) and awarded to undergraduate Oregon residents based on need and allowable funding. Twelve terms of eligibility are possible. The grant is awarded to eligible students attending half time or more. This grant is not available during summer term.

Recipients of Oregon Opportunity Grant should be aware of the Priority Deadline Dates for submitting any additional information needed to complete their financial aid awards. Failure to meet the Priority Deadline Dates will delay the disbursement of Oregon Opportunity Grant. OSAC requires schools to report disbursements before the end of each term. The actual date of reporting is set by OSAC each year. Verification of your file must be completed prior to disbursement. If your file has not been verified prior to OSAC’s required reporting date, your Oregon Opportunity Grant (OOG) will be canceled for the entire academic year.

Oregon Promise

The Oregon Promise Grant was created by the Oregon Legislature beginning with the 2016-2017 year. The Oregon Office of Student Access and Completion (OSAC) are responsible for the awarding and administering of the program. Continuation of the program in future years is contingent upon state funding.

Recipients of Oregon Promise Grant should be aware of the Priority Deadline Dates for submitting any additional information needed to complete their financial aid awards. Failure to meet the Priority Deadline Dates will delay the disbursement of Oregon Promise Grant. OSAC requires schools to report disbursements before the end of each term. The actual date of reporting is set by OSAC each year. Verification of your file must be completed prior to disbursement. If your file has not been verified prior to OSAC’s required reporting date, your Oregon Promise Grant will be canceled for the entire academic year.

Oregon Promise Video - Introduction for Students

Office of Student Access and Completion (OSAC)

The Office of Student Access and Completion (OSAC) is an office of the Higher Education Coordinating Commission (HECC) committed to assisting Oregonians in their pursuit of higher education and a brighter future. Established in 1959 by the Oregon Legislature, OSAC provides innovative funding and programs to Oregon students and families. Each year, OSAC awards grants and scholarships of more than $118 million to thousands of Oregon students. Prominent grant programs include the Oregon Opportunity Grant, the Oregon Promise Grant, the Chafee Education and Training Grant, and the Oregon Student Child Care Grant. OSAC also administers the ASPIRE student mentoring program, the FAFSA Plus+ program, outreach services, and statewide publications.

Oregon Promise:

The Oregon Promise application is currently open, as of this week.

Who can apply right now?

The application is available to high school and GED(r) students graduating between

July 1, 2021 - June 30, 2022. Use the Find Your Deadline tool. (For spring high school graduates, the deadline is June 1 each year.) Students can

APPLY NOW.

Oregon Promise Handout

A reminder that our Oregon Promise handout available in both English and Spanish. Please refer to this resource and share widely.

High School Registrars: GPA Verification

If you are a high school registrar, please log into the OSAC Partner Portal EARLY and OFTEN during the academic year. Students can start requesting GPA verification

for their Oregon Promise eligibility now. For most students (those who graduate after

March 1), they will need at least one term of completed senior grades in order for

you to be able to verify their GPA (typically in January-February).

For students who will graduate between July 1, 2021 and February 28, 2022, you can verify their GPA without senior grades. The first deadline for GPA verifications is Monday, November 8 (Winter Cohort Students).

Expected Family Contribution (EFC) Criteria

For Oregon Promise, students may be subject to eligibility requirements based on their

EFC. EFC eligibility requirements are subject to change based on available funding.

- For current 2021-22 recipients, there is no EFC limit for Oregon Promise.

- For next year (2022-23), EFC criteria has not been determined yet. All interested students are encouraged to apply for Oregon Promise by their deadline, regardless of their EFC or income level.

ORSAA (Oregon Student Aid Application): The 2022-23 ORSAA will open on Friday, October 1.

Reminder: ORSAA Tip Sheets

ORSAA Tip Sheets are available online (ORSAA Tip Sheet in English and ORSAA Tip Sheet in Spanish). Please share this resource at events, with students and families, and among your

colleagues. These three 1-page tip sheets cover:

- Understanding the ORSAA: Learn about who, when, how, and why it's important to file the ORSAA.

- Quick Tips to Complete the ORSAA: Tips to guide students (and parents) as they create an account and complete the ORSAA.

- I Filed the ORSAA, Now What: Learn about next steps after completing the ORSAA, and other financial aid opportunities.

When should students submit the ORSAA?

As soon as possible after October 1, in order to increase their chances of being awarded

state financial aid.

And of course, the FAFSA will also open on October 1 !

For questions about Oregon Promise or the ORSAA, please contact:

Kyra King

State Grants Administrator

Office of Student Access and Completion

An office of the Oregon Higher Education Coordinating Commission

971-332-0120

Oregon Student Aid

pronouns: she/her/hers

More Questions and Answers

Students receive the following types of correspondence at various times in the financial

aid process:

Receipt of FAFSA email: When your FAFSA is received, you will get an e-mail notification

asking you to login to your WebRunner account to view your outstanding requirements.

Note: This will be sent to your school email, unless you don’t have one yet, in which

case it will go to the email address you listed on the FAFSA.

Additional Information Letter and/or Phone Call: You will receive an additional information letter if you submitted incomplete forms. You may also receive an additional information letter or a phone call when your file is being reviewed by a financial aid advisor and he or she needs clarification or additional documentation. It is also possible to receive one of these letters after you have been awarded if a unique situation arises.

Financial Aid Award Notification: When your file has been awarded, you will receive an email asking you to login to your WebRunner account to view your award. Note: This will be sent to your school email address.

Loan Instructions E-mail: If you received a Financial Aid Award Notification and accepted the loans that were offered to you, you will be placed in a federal database. In three to five business days, you will receive the Loan Instructions Email with further instructions on how to complete the loan process. Note: This will be sent to your school email address.

Yes! The financial aid office is here to help you. You can schedule an appointment and one of our advisors will assist you in completing the FAFSA. Your appointment will go smoother if you are prepared with a few things in advance:

- Complete your FSA ID. This is the first step of the FAFSA and each person on the FAFSA must have one. This includes all contributors (students and those if applicable: spouses, parents, and step-parents as applicable).

- Bring your tax information for all filers. For 23-24 this is 2021 taxes. For 24-25 this is 2022 taxes.

You can also call the Federal Student Aid Information Center at 1-800-4-FED AID (800-433-3243). The Department of Education also provides answers to frequently asked questions about the FAFSA, and FAFSA on the Web Live Help, a secure online chat session that allows you to ask questions of customer service representatives. We may refer you here from time to time if we are not able to answer your questions

If you are a new student who has yet to complete the admissions process, financial aid will use the email you listed on the FAFSA. Once you have completed the admissions process, we will use your LBCC email account.

WebRunner is the electronic Student Information System. It is a secure database containing your personal information. In addition to many other items, it allows you to view your outstanding financial aid requirements and your award notification.

It depends. If you are making satisfactory academic progress and satisfied all of your outstanding requirements, then you are likely at step four of the Financial Aid Process. It typically takes about 8-10 weeks for your file to be reviewed, but can be longer during peak times.

During the review process, you may be asked to submit additional documentation, meet with an advisor, or clarify certain information. The length of time that this step takes depends upon your promptness in responding to these additional inquires.

If necessary, the financial aid advisor will make corrections to your FAFSA information. It can take up to another two weeks to get those corrections back from the federal government.

If you are eligible, your file will be awarded after all of these steps have been completed.

No. Financial aid must be awarded by each school. Furthermore, if you are transferring within the same academic year, you will need to cancel your financial aid at your previous college(s) and provide LBCC with documentation to show that it has been canceled.

No. Federal Direct Loans are awarded based on your financial aid eligibility, not your credit history. No credit checks will be run. Once loans are taken out, however, they will have an impact on your credit. Defaulting on your student loans, for example, will negatively impact your credit score.

If your household experienced a situation that caused your income to change significantly, please request a Special Situation form and meet with a financial aid advisor during an available drop-in time. Substantial documentation is required and only extenuating circumstances will be considered. Quitting work to go back to school is usually not considered an extenuating circumstance.

Direct Deposit is a very convenient option offered by the LBCC Business Office to have your financial aid refunds deposited quickly and safely into your bank account.

Sign up for Direct Deposit by logging into WebRunner:

- Click on "Personal Information" menu

- Then go to "Direct Deposit Authorization for Student Financial Aid / Tuition Refunds"

- Remember to update your WebRunner banking info when there are changes

No. Each term’s award is subject to your enrollment in that term.

Generally, eligible academic programs are those that are at least one year in length, lead to a degree or certificate, or provide full credit toward a baccalaureate degree. Check with the LBCC Financial Aid Office if you are unsure of the eligibility of your program.

Yes, but only temporarily and if you are a new student. You must declare an eligible major before you have attempted 30 credits.

You must meet the Satisfactory Academic Progress (SAP) requirements (see "Academic Standards for Financial Aid," above) in order to remain eligible for financial aid. Failure to meet these standards will result in the loss of financial aid eligibility for all future terms, unless you successfully petition for reinstatement.

If you have extenuating circumstances, you should complete a Financial Aid Appeal Form.

If your suspension was not based on extenuating circumstances, you must enroll and successfully complete six or more credits without the assistance of financial aid. Once this task is complete, you will be able to request reinstatement of your financial aid by completing the Financial Aid Appeal Form. Reinstatement is not guaranteed.

In the event that your Financial Aid Appeal is denied, you may drop in during posted appeal hours to have your appeal heard in person. Please be sure to bring the completed Student Appeal Form with you to your appeal.

Instead of meeting with the appeal committee, you may also elect to enroll and successfully complete six or more credits without the assistance of financial aid. Once this task is complete, you will be able to request reinstatement of your financial aid by completing another Financial Aid Appeal Form. Reinstatement is not guaranteed.

This is a complicated question because it varies depending upon the situation. You may wish to meet with a financial aid advisor during an available drop-in time to discuss your details.

The financial aid advisor will go over the Academic Standards for Financial Aid with you. Under these standards, it is generally better to receive a “W” over an “F” because the “W” only negatively affects your completion percentage, while the “F” affects your GPA and completion percentage. Both, however, count as classes that you attempted and did not complete. So, in many circumstances you may lose your eligibility regardless of whether you received a “W” or an “F”.

Federal Direct Loans are considered part of your financial aid package and are subject to the same academic standards as grants.

If you drop a class before the tuition due date for each term, you will not be paid financial aid for it and it will not affect your Academic Standing for financial aid. Dropping classes after the tuition deadline, however, may impact you. Students are expected to stay in compliance with the Satisfactory Academic Progress (SAP) requirements (see "Academic Standards for Financial Aid," above).

On the Academic Standards page, there is a chart which shows what will happen to a student’s financial aid if he or she fails to complete all of the attempted credits. In addition to the chart, students are expected to meet the other cumulative requirements listed. Furthermore, students who do not complete any classes may owe a repayment of their financial aid and may be denied financial aid at LBCC and all schools.

You may add classes, but in most cases it will not affect your enrollment level for financial aid purposes. On the date of disbursement for each term (the first Monday of the second week), we will look at what you are enrolled in and pay you accordingly. Adding classes after you have been paid will not increase your financial aid.

You should complete a Revision Request Form to notify the financial aid office that you will not be attending for the term. Your award will then be revised. In most cases, students would still be eligible to receive the financial aid for the future terms that they were previously awarded.

If you don’t attend for an extended period, you may have to begin making loan repayments. Loan payments start six months after your last date of at least half-time attendance (6+ credits).

You do not need to notify us. Financial aid is awarded at full-time status. Your aid will automatically be adjusted based on your actual enrollment level on the date of disbursement.

You do not need to notify us. Financial aid is awarded at full-time status. Your aid will automatically be adjusted based on your actual enrollment level on the date of disbursement.

You must be enrolled in at least six credits, which is considered half-time enrollment.

Go to the Online Scholarship and Application System.

Scholarships and other resources that you might receive will count as a resource. All of your financial aid combined, including grants, loans, and other resources, cannot exceed the Cost of Attendance. This means that in some circumstances we may have to decrease your loans offered because of scholarships or other outside resources you are receiving. The Pell Grant and Oregon Opportunity Grant will not be reduced.

If you expect to receive off-campus scholarships, grants, or other assistance, you are legally obligated to report the amount(s) to the financial aid office.

Federal Work-Study (FWS) is a need-based program made available by the federal government to qualifying students enrolled in at least six credits. Students awarded FWS need to secure a job on campus and work towards their maximum award amount. The maximum award amount is simply the most money that students can make in a term and does not represent what each student will receive. Students will receive paychecks based on their hourly wage and the hours they worked.

If you have not been placed in a job by the end of the fourth week of classes, your work study certification may be canceled without further notice and offered to other students waiting to work. Students who have been awarded FWS for summer term, but secured a position that doesn't start until fall term, may submit a Revision Request Form asking for their award to be revised. This will prevent their entire award from being canceled for not securing a position in the summer.

REPAYMENT OF FEDERAL FINANCIAL AID POLICY